The Age: Half of Australians on financial brink as living costs bite

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Source: The Age, 2023

Author: Shane Wright

Half of Australians say they would battle to pay an unexpected bill, with warnings voters are now struggling to deal with a perfect financial storm caused by soaring interest rates, power bills and grocery prices.

There has been a 10 percentage point jump since the start of the year in the number of people saying they would find it difficult to cover the cost of replacing a fridge or repairing a car, and the financial pressure is being felt by everyone from high-income earners to the unemployed.

The latest Resolve Political Monitor, conducted exclusively for this masthead and based on a survey of 1610 people between July 12 and 15, also shows a growing rift between Labor and Coalition supporters about who is responsible for high inflation.

The Coalition has stepped up its attacks on the government for its handling of cost-of-living pressures, putting the issue at the heart of its weekend victory in the safe Queensland seat of Fadden. But despite its criticisms, voters have yet to blame Prime Minister Anthony Albanese and Treasurer Jim Chalmers; the government is still comfortably ahead of the Coalition in opinion polls.

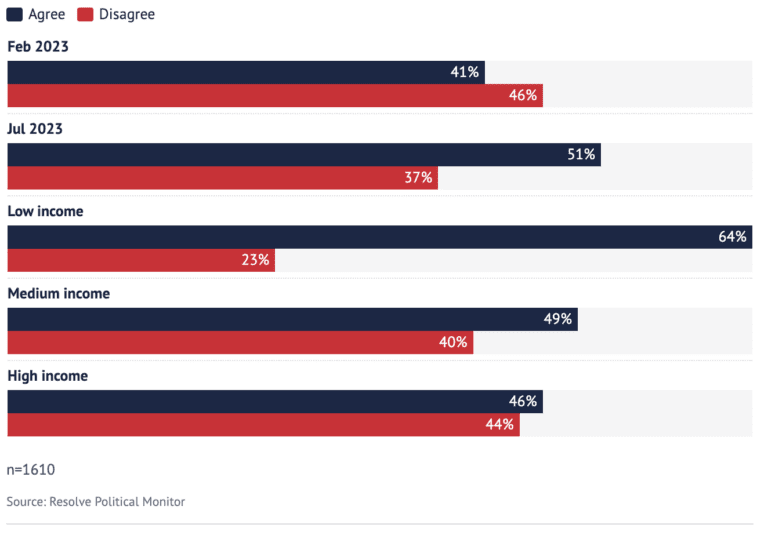

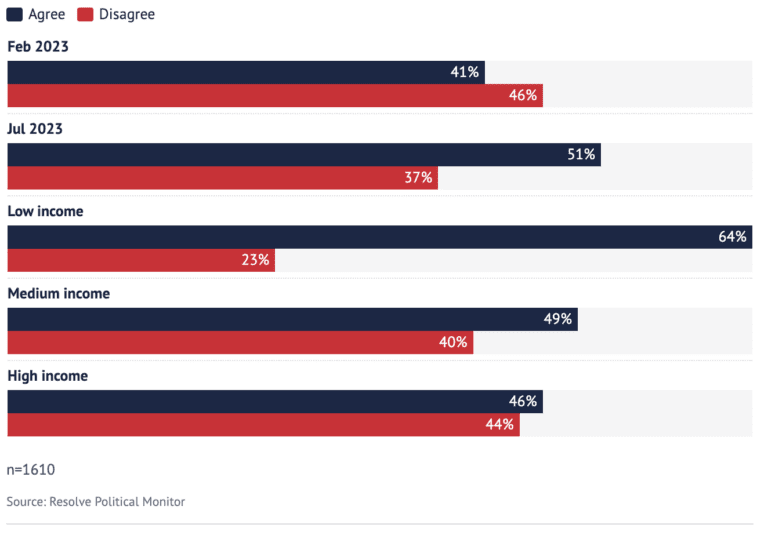

In February, the Resolve survey found 41 per cent of respondents said they would struggle to meet an unexpected major expense. In July, this had climbed to 51 per cent.

A question on the issue is often used in financial-stress surveys as it is a good indicator of the perceived and actual economic pressure being felt by consumers.

Q: Considering the rising cost of living, do you agree or disagree with the statement: “If I had a major expense of a few thousand dollars, e.g. needing a new fridge or a major car repair, I would struggle to afford it”?

Sixty-four per cent of low-income earners say they would have difficulty meeting an unexpected bill. But even among medium-income earners (49 per cent) and high earners (46 per cent), there has been a sharp lift in evidence of the financial pain facing most Australians.

Half of employed respondents said they would struggle, while 62 per cent of unemployed respondents would have problems.

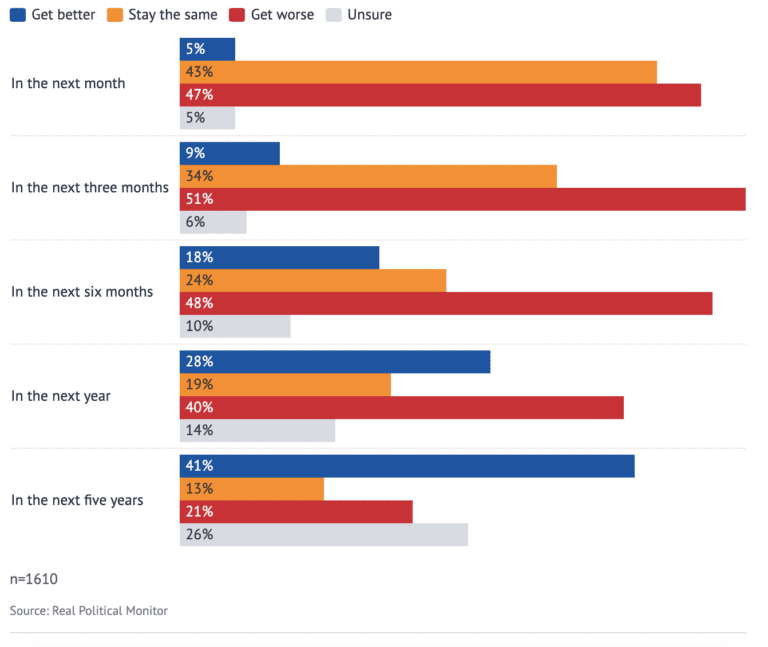

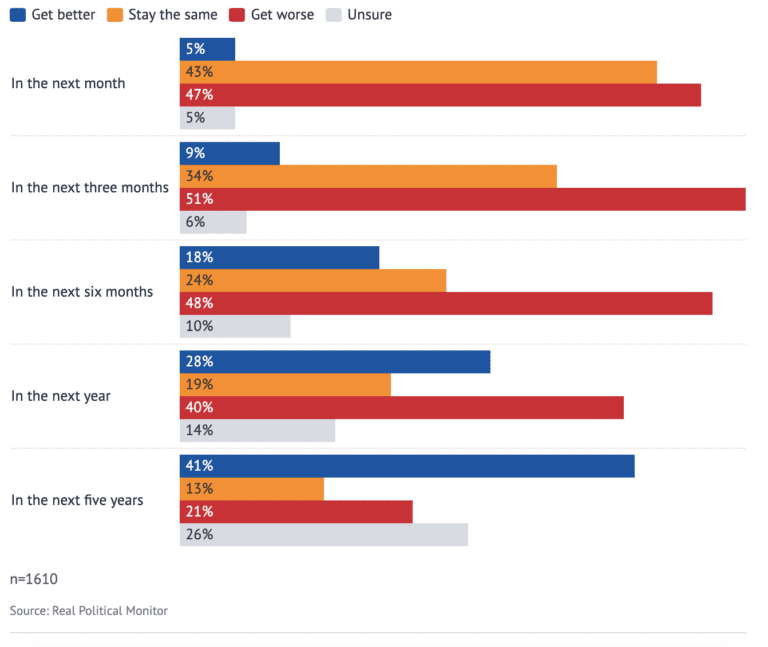

The survey also showed people are not expecting the nation’s economic circumstances to change any time soon. Just 5 per cent believe the economy will improve over the next month, compared with 47 per cent who say it will get worse.

Over the next year, 28 per cent expect improvement while 40 per cent are preparing for a deterioration.

Q: Thinking about the future, do you think the economy will get better, get worse or stay the same over the following timeframes?

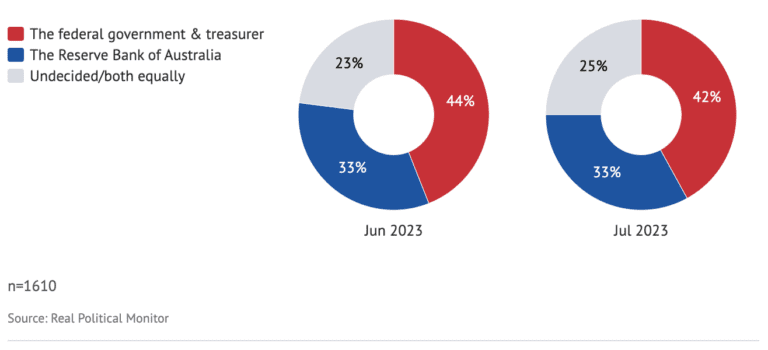

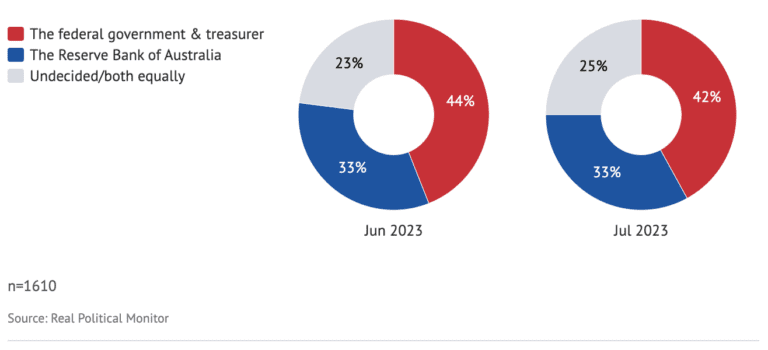

A key issue is inflation. A third of respondents say managing inflation is the responsibility of the Reserve Bank, which is mandated to keep it between 2 and 3 per cent. Forty-two per cent believe it is the job of the government, while a quarter say both have a role.

But on party lines, 51 per cent of Coalition voters say inflation management is the role of the government, compared with 34 per cent of Labor supporters.

Research by credit bureau illion confirms the pain being felt by many Australians.

Illion, analysing the credit behaviour of 18 million people, found the risk of credit default had jumped by 9 per cent since January last year. Most of that increase has been since November, when the Reserve Bank had the official cash rate at 2.85 per cent.

The cash rate is now at 4.1 per cent, and many economists expect the RBA to lift it at least once more, to 4.35 per cent.

There has been a 9 per cent jump in the proportion of people at least 30 days behind on their credit card and other revolving credit facilities. Delinquent home loans are 5 per cent higher than a year ago.

There has been a 40 per cent increase in the number of applications for revolving credit facilities over the past year.

It is not just debtors struggling; illion also found a drop in the number of people able to save.

Q: Who do you think has the greatest responsibility for keeping inflation down?

Savings balances have fallen by 40 per cent since October last year.

Illion’s manager of bureau analytics, Michael Landgraf, said it appeared many Australians were now struggling to deal with ordinary bills, forcing them to use credit to manage their day-to-day expenses.

“A perfect storm of rising household and rental costs, rising credit demand and credit delinquency, together with lower savings may be pointing to impending credit losses,” he said.

The Resolve survey also confirmed that a plurality of voters support the stage 3 tax cuts – due to start from July 1 next year – but a majority are either opposed or unsure.

Thirty-eight per cent backed the cuts, which will reduce tax for all people earning more than $45,000 a year but which will cost the budget more than $20 billion in their first year of operation.

Coalition voters (46 per cent) are much more likely to support the cuts than Labor voters (35 per cent) and supporters of other parties (33 per cent).

Twenty-six per cent of respondents opposed the cuts, with supporters of other parties (32 per cent) more likely to reject the reforms than Labor (28 per cent) or Coalition (21 per cent) voters.

There remains a large proportion of people (36 per cent) unsure or who have a neutral attitude towards the tax cuts.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.