The Age: Half of Australians on financial brink as living costs bite

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Inflation and a cost of living crisis are at our door. Here’s how employers can encourage savings and reduce employee churn in the process.

Source: HRD, 2023.

Employers been focusing heavily on mental health and wellbeing over the past few years – but for many Australians, money remains a leading cause of stress. In 2021, 30% of Australians were reported living pay cheque to pay cheque. Approximately 50% didn’t have $500 for an emergency, and 60% didn’t believe they could ever achieve financial security. At a time when we’re all painfully aware of the cost of living crisis, these numbers paint a stark picture – but for employers, a tough economic environment means they can’t always solve this with pay rises across the board.

Still, employees are increasingly looking for more support across different areas of wellbeing. Whether it’s through financial mentorship, help with generating savings, or wage flexibility, supporting financial wellbeing can do wonders in enhancing employee satisfaction.

According to Sandra Matz, associate professor of business at Columbia Business School, our expectations of employers have evolved significantly over the years. A job is no longer viewed just as a pay cheque but as something that plays a significant role in who we are day-to-day.

“If you look at Maslow’s hierarchy of needs, we used to expect our jobs to fulfil the basic needs – putting food on the table and providing basic forms of security and safety,” Matz says.

“But those days are long gone, and today we expect a lot more from our employers. We don’t only expect them to fulfil our psychological needs like belonging and esteem, we also expect them to go all the way up to the top of the hierarchy – to help us become the best versions of ourselves and achieve our full potential.”

While expectations of employers have increased, Australia is also seeing its highest job vacancy rate since 1970. On top of that, the pandemic has exacerbated issues such as financial stress, leading to sick days and absenteeism, and if employers aren’t offering adequate levels of support, the figures show that employees have no trouble going elsewhere.

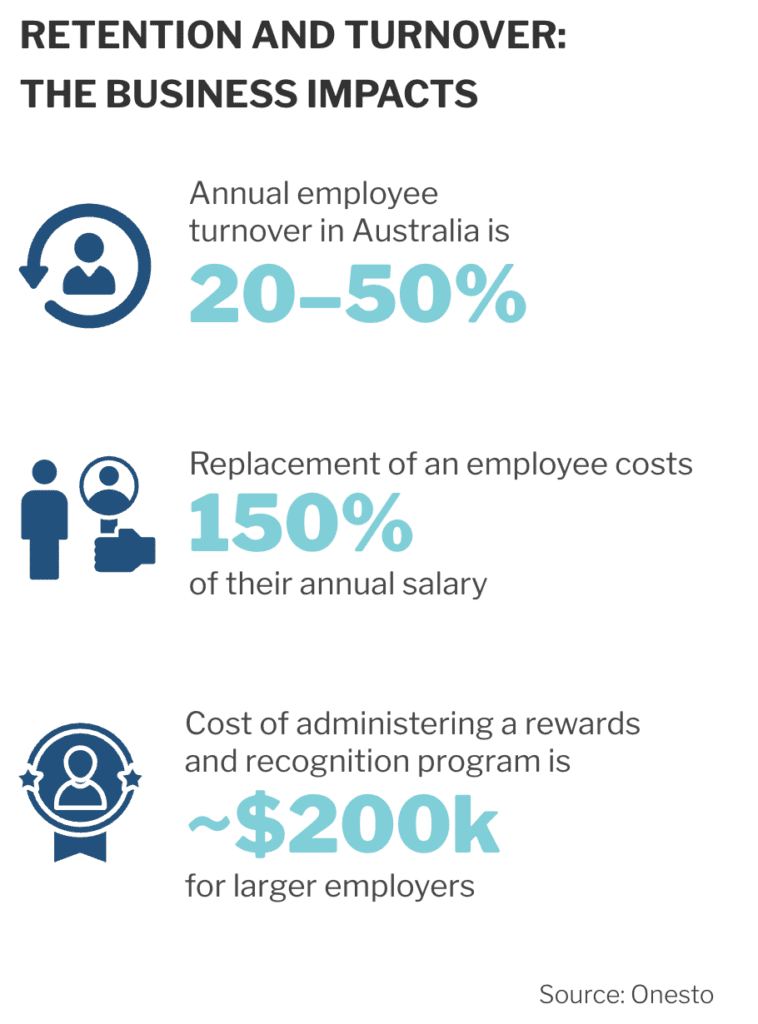

The average turnover in some industries is currently 57.3%, and with rising recruitment costs, replacing employees is becoming a lengthy and costly process.

SANDRA MATZ, COLUMBIA BUSINESS SCHOOL

To address some of these issues, Matz is currently working with Onesto – a financial wellbeing platform that helps employees to accumulate savings, access wage flexibility, and gain financial education through more than 100 courses.

Matz says Onesto’s mission is to help employees feel recognised for the work that they do, but also to help them build a financial safety net, which is so important in today’s volatile climate.

“We try and help employees to seriously accumulate savings that they can use for the things that really matter to them,” Matz says.

“Anyone who’s tried to save in the past knows that it’s hard. It’s really hard. You have to give up something in the now to potentially benefit in the future. As it turns out, our brains are not really good at making those decisions, so despite our best intentions, most of us fall short when it comes to saving enough for a rainy day or for retirement.”

Matz notes that 60% of Australians are currently worrying about debt, and over 6.3 million reported using ‘buy now, pay later’ products like Afterpay as of February 2023, which adds to consumer debt. Since financial wellbeing is closely tied to other forms of wellbeing, including physical and mental health, there is no better time to start thinking seriously about the financial wellbeing of your employees and how this can help you improve your turnover rates.

“Employees who are struggling financially are more likely to be absent from work due to health issues,” Matz says.

“Imagine not sleeping for a night – that’s the equivalent of 15 IQ points or experiencing financial distress. Having to worry about your finances hijacks mental bandwidth, which would be much better spent elsewhere, inside or outside of the workplace.

“Saving needs to be easy,” Matz adds. “It needs to be something that happens naturally to people where they continue to live their lives – business as usual.

“That’s exactly what Onesto does. By connecting you to major essential retailers in Australia, Onesto helps employees to build savings naturally, through saving up to 10% on each purchase they make.”

For employers, the Onesto platform has already proven its worth in spades. From Onesto’s most recent controlled trial, a client with over 2,000 employees has witnessed a significant decrease in employee turnover thanks to Onesto:

Average employee turnover of non-Onesto employees was

Average employee turnover of Onesto users (defined as: made at least one transaction in Onesto) was

Average employee turnover of Onesto Super-users (defined as: made 20 transactions or more in Onesto) was

Ultimately, inflation and a rising cost of living are an ongoing reality for every employee. We are likely to be dealing with the economic, physical and psychological after-effects of the pandemic for some time. In this environment, financial wellness is critical, and an employer that can boost financial wellness will enjoy the benefits of strong employee attraction and reduced churn.

“To me, Onesto is really a tool to help employees become the best versions of themselves,” Matz concludes.

“By doing so, you not only increase long-term loyalty among employees, but you also drive productivity and ultimately boost your profitability.”

To find out more about Onesto and how it can boost the financial wellbeing of your employees, click here.

SANDRA MATZ, COLUMBIA BUSINESS SCHOOL

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.

Managing employee retention in a post-pandemic world Employee retention requires intentional steps to keep employees engaged and focused so they choose to stay on the job.